Ketch: The Stripe of Data Privacy & Governance

- mukil0

- Aug 31, 2021

- 7 min read

Updated: Dec 1, 2021

The Don Valentine Perspective:

Bet on the idea. Do you believe in the products a company offers?

Products & Value Add

A month ago, I sat down with a VP at Ketch to talk about the company's rapid growth over the last year, as well as their outlook for the future.

He began with a one line, high-level description of Ketch's business model:

"Our goal is to be the Stripe of data privacy"

That's a lofty comparison, to say the least. Stripe is worth nearly $100 billion; it has revolutionized the fintech industry and pushed the API-backed business model to the forefront of tech.

Ketch, like Stripe, offers an API as its primary product. Ketch's goal is to help other companies adhere to ever-changing data privacy regulations, the most prominent of which is the EU's General Data Protection Regulation (GDPR). Ideally, a company that has access to Ketch's product can make a simple API call from within their existing code to ensure that all the user data they collect and store follows up-to-date data privacy regulations.

In theory, this sounds great; it simplifies the regulatory aspects of corporate data storage significantly. But why would companies pay Ketch for their product rather than taking the time to restructure their existing data to fit regulations? What drives the need for an API compared to a one-time manual refresh of company data practices?

First, an overwhelming majority of companies do not have the legal firepower to decipher dense data regulations like GDPR. For any company to ensure compliance and reform its data, it would first need to understand exactly what the regulations ask for. It would take significant time and effort for a company to both understand regulations from a legal perspective and adhere to them from a technical perspective.

Second, while large companies like Microsoft or Google may have the legal firepower to decipher the regulations, it is a significant hassle to keep up with regulations that are evolving very, very quickly. Legal teams would need to continually decipher new regulations that are put in place, and data engineers would in turn need to continually change the way they store their data from a programmatic standpoint. For a company with billions and billions of data points stored in tens of thousands of databases, restructuring again and again is simply not a feasible way to stay afloat.

Once companies have integrated Ketch's product with their code, they no longer have to worry further about the impact of new regulations. All the work is done on Ketch's end, and the client can be assured of their compliance.

The speed at which Ketch has come out with such a comprehensive product has been impressive.

In addition, the company has diversified into developer tools like Smart Tag, which helps web developers ensure that website performance will not be impacted by the data compliance checking that goes on behind the scenes.

All previous attempts at similar products came at the expense of performance - this is a significant value add for companies with millions and millions of website visits on a daily basis.

Why does page performance matter? First, Google's SEO algorithm factors in page performance metrics, so Smart Tag can help companies ensure that customers can find their page. Second, studies have shown that every additional second that a page takes to load can lower customer conversion rate by 20%. No other competing solution delivers on both compliance and performance, but the choice between the two is not one companies should have to make.

Put simply, Ketch presents the following question to potential clients: would you like a quick, easy and customizable solution that ensures that all your data meets ever-changing privacy regulations, without sacrificing website or app performance?

Or would you rather spend significant time and money trying to build a team to solve the compliance issue from the ground up, taking resources away from your core business operations?

Sales and Marketing

The answer to the question posed in the previous section seems clear to me, and is starting to become clear to several high-profile clients that Ketch has already secured.

Patreon, Smartsheet and Sixth Street have all turned to Ketch to solve their data privacy issues in 2021. All 3 are multi-billion dollar companies and leaders in their respective fields. Growing companies like Selina, and Chubbies, both boasting valuations well north of $100 million, have become clients as well.

The most telling part of Ketch's growth is how quickly clients have latched on to the value that the company's products can provide. Ketch was founded in 2018, and picked up its first round of serious funding in March of 2021. The last few months have seen the company take off, landing nearly all of the aforementioned clients.

Within the last week, Ketch also announced a promising partnership with data giant Snowflake. Snowflake, valued at more than $100 billion, provides cloud-based data warehousing services for several of the largest companies in the world, including jetBlue, Capital One, DoorDash, Disney, and KFC.

Ketch's partnership with Snowflake gives mutual customers access to Ketch's data privacy controls and and customizable governance policies. It also allows companies who store their data with Snowflake to easily manage data access permissions in a scalable way while maintaining regulatory compliance.

This partnership is huge news for Ketch. The issue of data compliance is one that nearly every major company in the world has to address, and several such companies rely on Snowflake to house their data.

Given that Ketch now has easy integration with Snowflake, many of Snowflake's clients may soon look to Ketch for solutions. From a sales perspective, Ketch has done everything right to position itself for takeoff. It has multiple high-profile clients already, and has entered into partnerships likely to attract more high-profile clients in the months and years to come. Data regulations aren't going away any time soon, and Ketch is starting to establish itself as a force to be reckoned with in a quickly expanding market.

The Georges Doriot Perspective:

Bet on the team. Do you believe in the people spearheading the company?

Team

The company's two co-founders, Tom Chavez and Vivek Vaidya, are successful serial entrepreneurs from exceptional technical and educational backgrounds.

Chavez received his undergraduate degree in Computer Science and Philosophy at Harvard, and his Ph.D. in Engineering-Economic Systems at Stanford. Vaidya completed his undergraduate studies in Computer Science & Mathematics at IIT Delhi (the most rigorous, selective institution in India) and his Master's in Computer Science at the University of Denver.

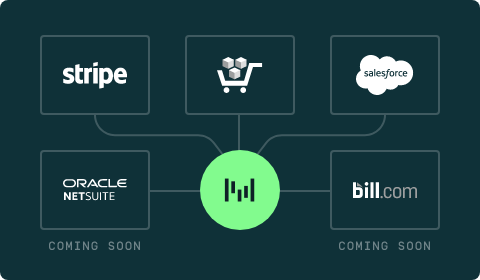

Chavez and Vaidya previously founded Krux Digital together. Krux, a data security tool for web developers, was acquired by tech giant Salesforce in 2016 for north of $750 million. The two also co-founded Habu, a mar-tech company that just wrapped up its Series B at a post-money valuation of $150 million.

The two have shown clear chemistry as business partners and co-founders, and have the track record to show they can manage a company from the ground up to a successful exit. They have shown that they can reward VC trust, and in turn that they can produce technically sound products that are sought after by industry leaders.

There is perhaps no better founding team that a company could ask for. The founders have surrounded themselves with a technical executive team including a lecturer at UC Berkeley's globally acclaimed Data Science department, a former Director of Product Management at Salesforce, and a former VP of Engineering at Salesforce.

The executive team also includes a well-rounded group of legal, marketing, and finance experts. The team is culturally diverse, too; there is a significant amount of research suggesting that diverse founding teams are far more likely to succeed than equally capable teams without a focus on diversity. Coupled with the technical expertise and entrepreneurial background of both the founders and the executive team, this diversity makes it very, very hard not to believe in the efficacy of Ketch's leadership team.

Financing

In the last year, Ketch has received $43 million in VC-backed funding in 2 tranches. It raised $20 million Series A funding in March at a pre-money of $39.80 million, and just months later, in September, raised $23 million Series A2 at a pre-money of $115 million. There is perhaps no better indicator of the company's rapid growth rate than its valuation step-up of 2.08x between the post-money of its Series A and the pre-money of its Series A2, in less than 6 months.

That being said, the company is still very early-stage. The Series A2 funding was completed in mid-September, and in the 2 months since, the company has announced a partnership with Snowflake, has been named one of Gartner's Cool Privacy Vendors, and started to diversify its product portfolio with data governance solutions to supplement the existing privacy solutions.

The one remaining consideration is the existing market, and an attempt at forecasting a ceiling that Ketch could realistically hit. OneTrust is clearly the biggest player in the data privacy solutions space. It has been around since 2016, and has raised $920 million in funding through its Series C.

The Series C was made at a post-money valuation north of $5 billion, and OneTrust appears primed to continue its growth in future financing rounds. Typical SaaS companies take 12-18 months to secure funding after a Series C - it has only been 7 months for OneTrust. The next several months will be very telling for OneTrust, but it is clear that data privacy is a multi-billion dollar industry. Ketch, should it continue its growth, will be able to reach a multi-billion dollar valuation as well, repaying investors handsomly.

The question then becomes whether Ketch has enough differentiation to grow despite the existence of OneTrust. Ketch's product base has three clear advantages: simplicity, cost and performance. Ketch's Smart Tag and API products were built to circumvent the typical tradeoff between performance and privacy implementation, as mentioned above. The Ketch team has demonstrated that website performance is nearly two times better with the Ketch API as compared to the OneTrust API.

The second differentiator is simplicity. Ketch's products were designed to be exceedingly simple to implement. The team believes that complexity holds organizations hostage, and simplicity drives organizational progress. All of Ketch's products are designed to make data control simple and painless, regardless of which new regulations are put in place.

The last, and perhaps most important differentiator is cost. Ketch's solutions are more cost efficient than OneTrust's, put plain and simply. The timeline of both companies is also beneficial for Ketch. Data regulations have truly taken center stage in 2021. Amazon was hit with a $877 million fine in July of 2021 for breaching the EU's GDPR regulations. WhatsApp was fined $255 million just months later. The market for privacy solutions is starting to explode as a result of these front-page events, and Ketch has fully developed its superior suite of products just in time to make a serious run at potential new clients.

Verdict:

Investors should be chomping at the bit to get in on Ketch's future rounds of funding. With the privacy market expanding, regulations constantly evolving, and the technical excellence of Ketch's product, we are looking at a company primed to hit the prized "unicorn" status within the next 5 years. Now is the time for prospective venture capital firms to acquire equity in Ketch. Large equity stakes in a company valued at $135 million certainly is not cheap, but it is much cheaper now than it will be in 5 years. Book it.

Comments